Whenever I drive, I listen to whatever podcast my wife, Karin, was listening to (because Tesla disabled the FM band radio it used to have). Usually it’s How I Built This, or Shankar Vedantam’s Hidden Brain or other NPR fare. I was not expecting to hear my pal Jennifer Tescher interview Dr. Bechara Choucair on Emerge Everywhere. Not what Karin listens to. Not who I expected Jennifer to interview. Not the lesson I was expecting to learn.

Dr. Choucair is the Chief Health Officer at the very profitable non-profit, Kaiser Permanente. He learned that basic financial stability is a complete prerequisite for just about any physical health intervention. Without a roof over your head – any medicine pales in addressing depression and anxiety. Without ability to pay bills – hard to stick to a drug regimen. Kaiser surveyed 10,000 customers and discovered that three out of five – 60% – are missing at least one basic social need. One in five are missing three basic social needs. This led them to start a third pillar to their services: physical health, mental health and now “social health.” Listen to the whole interview here.

The US faces a complex landscape of interconnected challenges. Over 28 million adults experience food insecurity, nearly 40 million lack health insurance, and student loan debt surpasses a staggering $1.7 trillion. While solutions often address specific issues, a crucial factor silently underpins them all: financial security.

It’s not just about having a fat bank account. Our friends at Financial Health Network, say, “Financial health is more than just having money in the bank. It’s about feeling in control of your financial life and being able to weather unexpected expenses.”

Think of it as the foundation upon which everything else rests. Without it, we’re vulnerable to a cascading effect of negative consequences that can take a toll on our:

- Health: Studies, like a 2019 one in the Journal of the American Heart Association, have shown that financial strain can double the risk of high blood pressure, making us more susceptible to other health problems. Tight finances often lead to skipping preventative care, leading to more expensive treatment down the line.

- Education: Over 43 million Americans owe student loan debt, with an average balance exceeding $37,000. Wha? This burden can hinder individuals’ ability to complete their education or impact career choices. Conversely, financial security allows families to invest in quality education, fostering a more educated and skilled workforce, critical for economic growth and innovation.

- Housing: Insecure housing disproportionately affects low-income individuals and families, impacting their physical and mental health and perpetuating a cycle of poverty. A 2023 report by the National Low Income Housing Coalition found that there is a shortage of over 7 million affordable and available rental units for low-income renters in the United States. Promoting financial stability through affordable housing options, stable employment opportunities, and financial literacy programs can empower individuals to secure safe and secure housing, fostering stronger communities and reducing social costs.

- Environment: Seemingly unrelated, financial security plays a role in environmental sustainability as well. Individuals struggling financially may be less likely to invest in energy-efficient appliances or sustainable practices due to upfront costs, exacerbating environmental problems. As Louise Johnson, Senior Policy Analyst at the Kaiser Family Foundation, points out, “Climate change disproportionately impacts low-income communities and communities of color, who often lack the resources to invest in sustainable solutions. Promoting financial security can empower these communities to make sustainable choices and contribute to a more environmentally conscious society.”

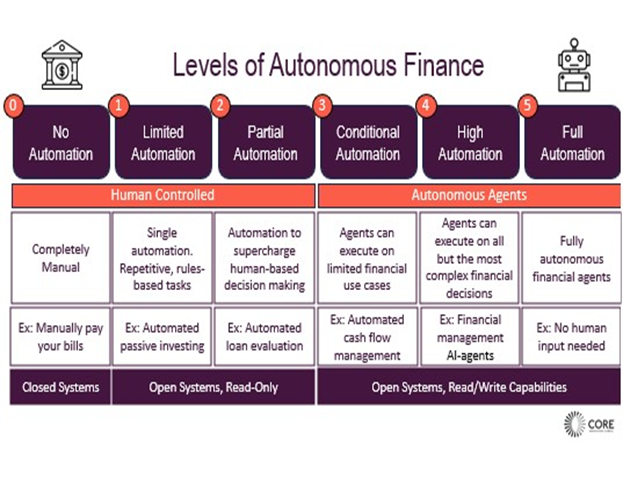

Our industry, fintechs, VCs, corporates, and nonprofits, need to see the ripple effects of limited financial security – limited financial health – more clearly. I don’t think it’s far-fetched to say that we won’t get far or fast enough on addressing climate change unless we provide some basic level of financial health for the every-person. Take India as an extreme example: they cannot afford to turn off fossil fuels lest they ease up on efforts to promote basic economic growth. We believe that AI, blockchains, and open banking technologies can have outsized impact in addressing these broader social problems and we are in the market for entrepreneurs who are similarly obsessed.