We recently issued a challenge to the fintech community to think outside the box and align the march of progress with financial emancipation for Black people. This was born from the blatant, but constantly ignored truth that if you happen to be born Black in the US, you’re likely to generate 10x less lifetime net worth than if you’re born white. Decades of well-intended effort to curb this have failed, and today the racial wealth gap is actually worse than it was in the 1970s.

Fintech has done a lot to increase access. The numbers of un(der)banked people are down. Lower-cost alternatives are much more prevalent today (as I’ve tried to measure here). But more has to be done to increase the affordability of financial services and the general net worth of Black and Latinx people. Most people agree; not enough people are acting. Most of those who are acting are doing so at a tiny scale. Technology is not the panacea to this problem, but tech can do a lot.

I’m really excited the venture and tech communities are spawning an array of efforts to this end. I love how PayPal and others are funding Black-led venture funds. Base10 Ventures launched a growth fund where 50% of profits go to Historically Black Colleges and Universities. There are many more examples like this than there were a year ago. Like Core, many VCs will meet with every minority founder, whereas we turn away thousands, sight unseen. I’ve started asking every board I serve on to take inventory of what they’re doing to address the racial wealth gap and brainstorm what more they could do. There is real cause for hope, but we have to keep at it until the numbers start telling a different story.

Every Company Is a Fintech

Of course, every company needs core capabilities in payments, credit, insurance and financial planning to operate. Increasingly, these fintech capabilities will become key drivers of competitiveness and differentiation. Much has been written about “embedded fintech,” but it’s still in the early days of what will be a multi-trillion-dollar industry. Fintech and non-fintech companies can leverage a new tech stack to create better financial products and more inclusive underwriting models. Solutions like Atomic (I’ll provide links to all Core’s portfolio companies mentioned here) can now embed payroll data into any application. We no longer need to rely on the FICO score alone. Cash flow and alternative data underwriting can lead the way to a more inclusive future. Core family company One does exactly that.

When every company can be a bank, banking can come to you. That is a huge development when financial technology has failed to reach many consumers it promised to help. Fintechs can embed financial products to meet people where they are. What if robo-advisor Betterment was provided within Tithe.ly, a church payments platform that reaches millions? The team at Mayvenn, an ecommerce beauty platform, has long discussed offering Chime-like banking to its hairstylists. How about a mash-up with aspirational brands, like Nike, and lottery savings app Yotta? Or Acorns? Reward yourself with a penny saved for each step. Adds up quickly.

As we saw during COVID, even small shocks can destabilize even squarely middle-class households. Low-income Americans are incredibly vulnerable to unexpected accidents. A healthcare expense is the number-one cause for bankruptcy. What if Pact could provide insurance automatically for every car that drives off the lot (otherwise uninsured)? Or if $5 of each diaper purchase contributes to a life insurance policy through Bestow’s APIs?

Next-Gen Homeownership

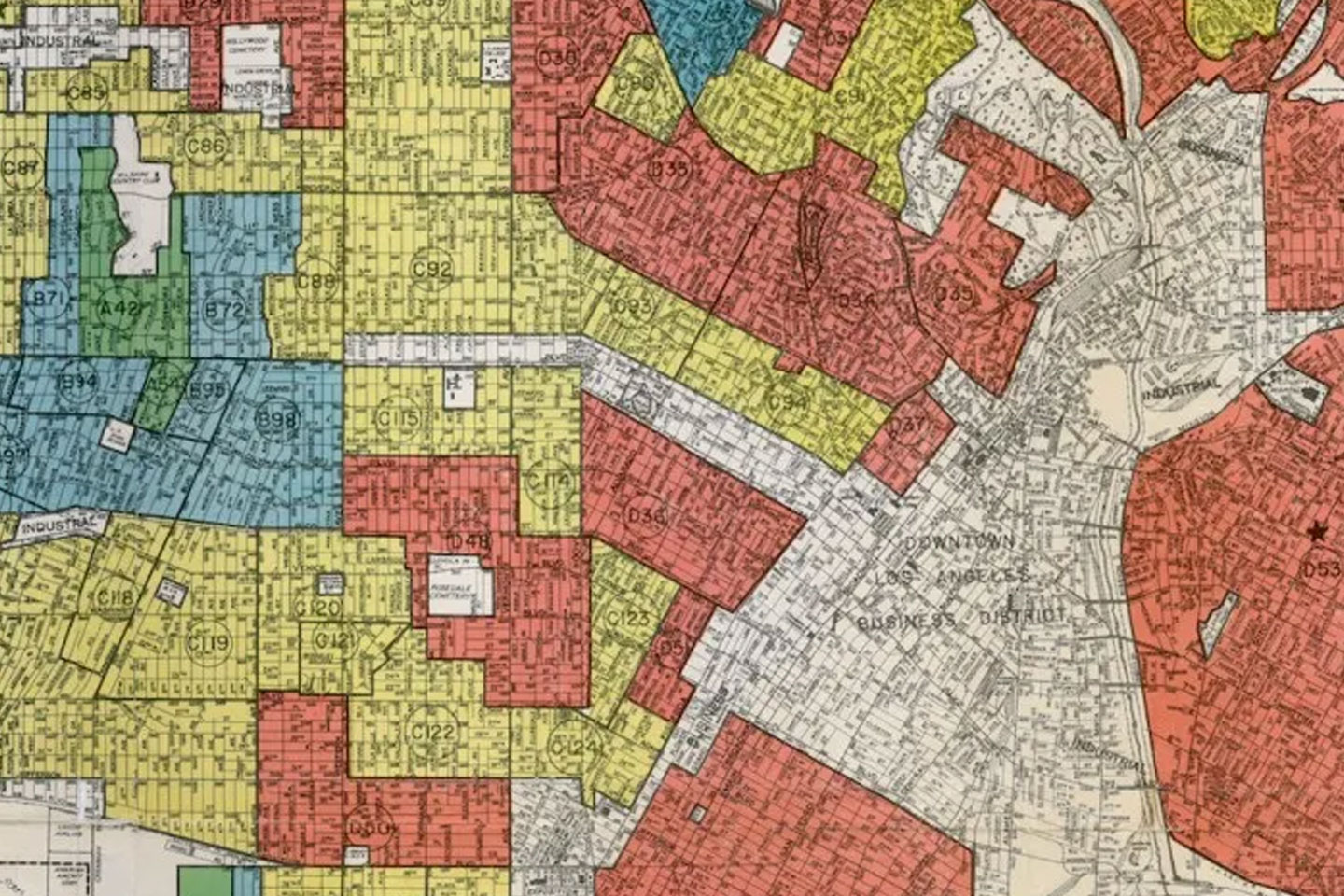

The largest driver of net worth in the US has been homeownership, but not everyone has enjoyed this anchor of the American Dream. Home ownership is largely unattainable for those who are credit invisible, including many Black Americans. Moreover, by some measures, Black-owned homes are underpriced by 23% relative to their white peers, and property values in Black neighborhoods remain stubbornly low. Let’s change that by changing the way real estate assessors do their work, or by creating property value insurance.

Fintech can reinvent what homeownership means. Cooperative ownership models can offer the benefits of homeownership without the large upfront costs. Companies such as Arrived offer a chance to own a fraction of a residential rental property for just $100. What if they partnered with affordable housing marketplace PadSplit and applied $50 of the weekly rent to owning a fraction of their home? Up&Up’s rent with benefits model offers ways to feel like a homeowner even when it’s not economically advisable to buy a home outright. The team at Esusu reports rental payments to simulate the credit-building feature of homeownership. What have you seen, or could you imagine, to make homeownership more attainable for Black renters?

Gov-Fintech

Government programs supporting affordable housing, healthcare and business support millions of underprivileged Black families today. These are important but often miss the intended recipient. Fintech can help here, too. Propel developed an EBT-focused product that helps around four million food stamp participants (out of approximately 40 million) check their balance, find stores that accept food stamps and track their spending. Forage is making it easy for all online retailers to accept food stamps. HealthSherpa helps direct consumers find the right ACA-compliant health insurance plans — like healthcare.gov, but better. Endless government entitlements could be turbo-charged by fintech solutions. When COVID just started, our friends at Blackhawk Network helped hundreds of millions of private and public dollars get to hard-to-reach populations. Brand new Column Tax is providing an API that will let people get access to their tax refund year-round (basically, get paid more). I am not even scratching the surface here.

My point here is we all need to put down our pencils, take stock of what we’re already doing and think of what more we can do, creatively. Fintech has incredible reach and the potential to scale massively. The racial wealth gap in the US is a national embarrassment, and both tech and finance can have an outsized hand in reversing it. We wrote More Money, Fewer Problems to get our community thinking outside the box. Let us know what you think and what you’re doing!

My thanks to David Roos, Mickias Hailu and William Crowder.

Also: CAC is breaking the bank, but will soon go away. The racial wealth gap is widening. How fintech can help reverse that.