Have we had the American Dream all wrong? For many, the American Dream is the idea of owning a home, knowing our kids will be better off than we are, and comfortably settling into the middle-class with an ever-appreciating real estate asset and a sufficiently growing living wage.

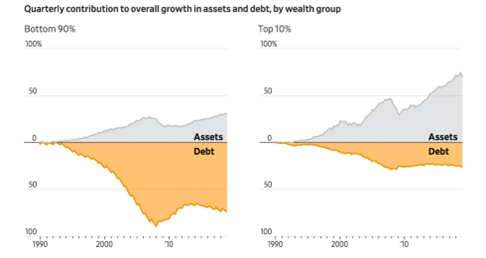

There are two huge problems to this narrative. First, access to this opportunity has never been equal and it is becoming even more unachievable for a broader segment of the population. Inflation-adjusted housing prices have risen astronomically for the past three decades and with high mortgage rates that means housing affordability is at a record low. Not surprisingly, home ownership has subsequently declined, particularly for younger generations (Chart 1).

Chart 1: Homeownership in Decline

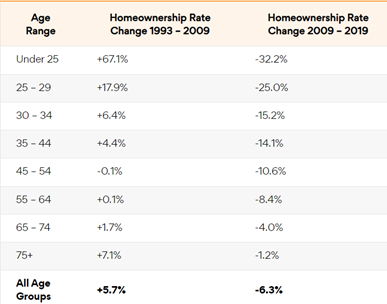

Second, we forgot to look under the covers. For 90% of the population, asset growth was built on the top of a mountain of debt (Chart 2). Earned income failed to keep up with the rising price of housing, education, or healthcare resulting in a much bleaker picture when we take a peek at what’s really driving asset growth. Even those appearing to live the dream seem to be burdened with nightmares of debt.

Chart 2: A Middle-Class Mountain of Debt

So how did the top 10% grow assets without amounting debt? Financial investments, which accounted for 78% of all asset growth over the past three decades.

This leads to the conclusion that there’s a promising alternative to our staged path to the American Dream– own businesses. Coincidentally we are primed to go through a massive business turnover over the next decade. $10T of small-to-medium sized private businesses (SMBs) need to be transitioned over the next two decades from Baby Boomers to the next generation. Diving deeper into the numbers, 2/3rds of family-owned businesses do not have a succession plan and only 30% of businesses ultimately find a buyer. Instead of spending time finding homes for ourselves, let’s find the future homes for these businesses.

With Baby Boomers reaching retirement, this demographic tailwind creates an impending need to act now. We can bring business ownership to the mass market, thereby creating a tangible path to achieving economic stability and empowerment. There are certainly hurdles in the way, but I’m excited for new business models, frontier technology, regulatory support, and capital providers to change the narrative and make business ownership more attainable.

Okay sure, but how?

Business owners on the verge of retirement have a few options. The first, and bleakest, is shutting down. Over 500k businesses close each year, and startups are even popping up to help shut down a business. This is obviously less relevant to our conversation, so let’s focus on the sources of optimism.

The second option is to sell the business to private equity (PE) shops or similarly-motivated buyers. Online brokers like BizBuySell list upwards of 65k businesses every year! Unfortunately, the process to list is costly, and the site is loaded with low-intent buyers with 80%+ of inquiries end up failing to close, largely due to lack of commitment, lack of capital, or weak buyer / business fit. This results in loads of wasted time for the business-owner and leaves her with a sour taste. Startups like Baton and OneDeal are trying to create a better brokerage, but frankly taking out the middle-men and complexity of closing a deal has yet to be solved. And the reality is there aren’t enough PE associates or HBS grads in the world to buy all these businesses.

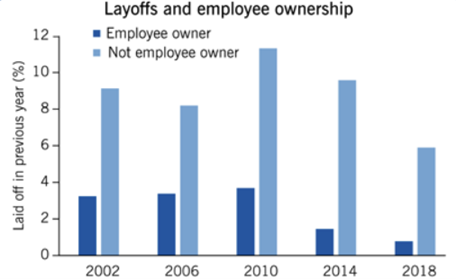

Another option is transitioning to employee ownership, an area that has tremendous potential for both owner-profits and employee-impact. The main avenue for employee ownership historically is an ESOP, or Employee Stock Ownership Plan. With an ESOP, a business sets up a trust fund that typically borrows money to purchase the shares of the business from an owner. The business makes tax-deductible contributions to the trust to pay back the loan. Employees own the trust, and thus the shares in the business, and when an employee leaves he either sells his shares back to the trust or on the open market. ESOPs are complicated and there are downsides to having to manage that structure, but they work. Workers in ESOPs typically end up with 3x the amount of retirement assets as employees of comparable businesses. As an employee, not only do you own in the upside, but you are incentivized to build a better business. This is exactly why tech businesses have widespread adoption of this model and so much shareholder value has been created for employees in Silicon Valley. Wages typically increase with a better performing business and you are less likely to lose your job providing a heightened level of financial stability (Chart 3). It is capitalism at its finest and startups like Zolidar or Sharevance are building platforms to make the transition for traditional businesses easier.

Chart 3: Stability through Cycles for Employee-Owned Businesses

Outside of ESOPs, there is another avenue to employee ownership gaining momentum, Employee Ownership Trusts (EOTs). In the UK, the number of EOTs established has grown from 52 to over 500 in the past three years. EOTs in the U.S. are still a newer concept, but there’s little doubt they will catch on because of the benefits. Typically structured as purpose trusts, EOTs in the U.S. offer (i) less regulatory overhang than ESOPs which require annual valuations, (ii) flexibility to align the long-term goals of the EOTs with the vision of the owner, and (iii) a lower cost to set up. The challenge is that capital markets are still warming up to the idea of EOTs. As a result, seller financing, i.e. the business owner cashing out over time instead of immediately, is typically needed. You probably heard of Patagonia using a trust to transfer ownership to its employees and maintain the business’ mission. Now startups like Common Trust are building platforms to bring this structure to the mass market. The first company Common Trust helped transition to employee ownership, Clegg Auto, doubled profits after years of stagnation and rolled out health insurance to its employees in its first year post-EOT. Think about the implications of this as we move into the unknown world of AI. If we want businesses to adopt efficiency-creating technologies like AI, I’d much rather have employees bought into the upside than demoralized with the downside.

Two big questions that remain for either the ESOP or EOT model: (i) where does the money come from, and (ii) who is going to run the business? A few startups are stepping up to help answer this question. Teamshares is a unique venture-backed business that is training new managers, raising capital to buy the business itself, and then transitioning to employee ownership over the next two decades. Meroka is taking a verticalized approach, focusing on healthcare businesses and creating physician-owned, rather than PE-owned, roll-ups of healthcare practices by initially buying the business but transitioning them to employee ownership over time. While these models are more asset-heavy than your typical scalable VC-backed software business, I’m personally excited to see creative investments for venture investments in this space.

Bridging the gap to business ownership

Driving wealth creation at such massive scale will take a team effort. First, we need regulation to make the process easier. California recently passed legislation that created an Employee Ownership Hub to educate owners on employee ownership’s benefits, streamline access to capital, and provide referrals to legal services needed to set up ESOPs. A federal bipartisan bill was introduced last year to use SBA funding to sponsor employee ownership. Spreading wealth broadly in a way that is pro-capitalism should be a bipartisan issue we can all align with. Let’s encourage lawmakers to keep loosening the red tape, particularly the burdensome tasks required to run an ESOP, and incentivizing debt providers to enter the space by awarding borrowing for employee-ownership as they have done with incentivizing mortgages.

Second, we need more debt providers willing to fund the transition to employee-owned trusts. Capital is a bottleneck to the process and thus far debt investors in the space have largely been impact oriented. But asset-backed private lending can be a lucrative business, particularly when employee-owned businesses are proven to outperform. I am positive that this asset class can have market-based returns over the next decade.

Third, yes, we need tech companies to create lasting change. I believe there will be a next-gen Carta for employee ownership, a software platform to simplify the documentation and complex processes of transitioning ownership while having an AI co-pilot translating data to the owner. Brokerages will still exist in the future (we’re talking about 10s of thousands of businesses that need transitioning!), but we can have AI brokers on the side of the owners rather than the buyers, ridding the principal-agent problem in the system and narrowing the asymmetric financial sophistication between the two parties. These agents will go through the due diligence process and make sure when the owner steps in there is high chance of a successful transaction. With tech, qualifying businesses should get 10x faster giving business owners 10x the chance of finding their businesses a home. These AI brokers could help educate the owners on employee ownership as an option before they sell-out to PE.

We need employees to feel empowered in an age where many are worried about their future in the workplace at all. AI-based management training and AI-assisted managers as part of the transitioning process to democratize business school curriculum and qualify a new generation of managers. Financial wellness-as-a-service within these businesses to create a more productive, aligned, and knowledgeable workforce.

We need entrepreneurs to keep innovating on business models, finding asset-light business models to make buying businesses scalable and attract higher multiples. In housing, we’ve seen the operation company/property company business model, better known as opco/propco, succeed in separating the assets and financing components of a business with the operating and revenue generating components of the business. Why don’t we create an opco/bizco model?

It’s time we rediscover the American dream and turn our focus towards business ownership.